Premium to discount: Silver ETF prices drop over 20% in a week

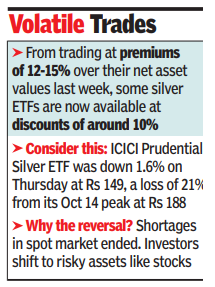

MUMBAI: Thanks to sharp corrections in price of silver recently, the price of exchange traded funds (ETFs) units on the white metal on domestic bourses have started trading at substantial discounts to spot prices. ETF rates are now down about 15-25% from their respective peaks recorded last week.Consider this: Silver BEES ETF, one of the biggest ETFs on the white metal in India was down 2.3% at Rs 142 on Thursday and was down 21% from its all-time peak of Rs 180. ICICI Prudential Silver ETF, another leading one, was down 1.6% on Thursday at Rs 149, a loss of 21% from its Oct 14 peak at Rs 188.From trading at premiums of 12-15% over their net asset values (which are linked to the spot prices) last week, some of these ETFs are now available at discounts of around 10%. Last week, due to the buying frenzy for silver ETFs by retail investors on the back of sudden and huge shortage in the spot market, ETFs were trading at such high premiums. Usually, ETFs trade at very small discounts to their NAVs, mainly due to holding of some cash by fund managers and some other operational adjustments, fund industry officials said.For silver ETFs, the recent move from premium to discounts was mainly because the earlier shortages in the spot market had almost ended, analysts said. In addition, with optimism surrounding India-US and China-US trade deals, investors globally are also buying risky assets like stocks again and moving away from haven assets like bullion. This in turn is putting a price pressure on gold and silver.

According to Rahul Kalantri of Mehta Equities, in the international markets, the prices of gold and silver stabilised around $4,050/ounce and $48/ounce after a sharp correction in the last two sessions as investors booked profits from Monday’s record highs. “The pullback reflected a shift toward risk assets amid optimism over US–India trade relations, weakening gold’s safe-haven demand. Seasonal demand in India also eased, putting pressure on physical markets,” Kalantri said.Market players, however, said that the volatility in the prices of silver ETFs seems to be a temporary phenomenon and prices would soon stabilise.