Trade tensions weigh on PE deal closures

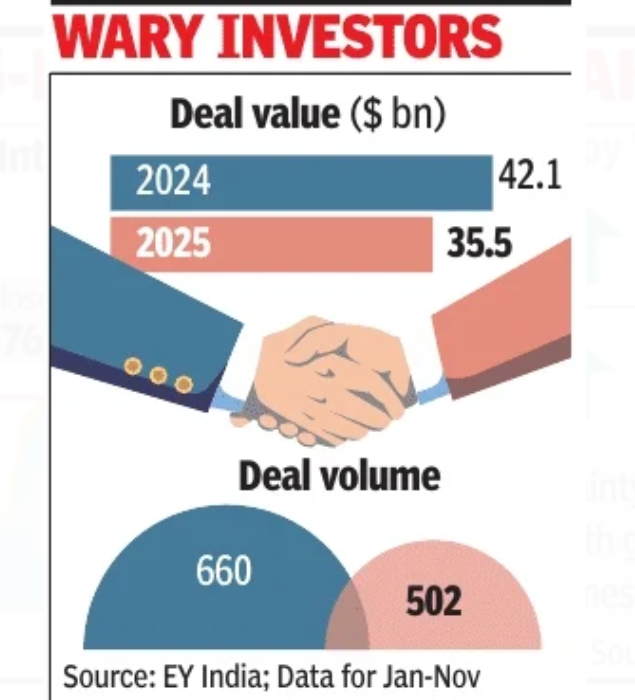

MUMBAI: Global private equity (PE) investors want to bet big on India and are scouting for investments, but President Trump’s tariffs and broader geopolitical risks are slowing down the pace of deal closures—PEs invested $35.5 billion in the country during Jan-Nov 2025, about 16% lower compared to the year-ago period, data sourced from EY showed. The deals covertransactions such as growth, buyout and private credit across sectors.Investors are assuming a cautious posture amid a delayed US-India trade deal. Besides, a weakening rupee is eroding the value of current investments, said a large global PE investor on condition of anonymity.

“A trade deal could reset sentiment and the rate at which investors value deals. A lot of PE money originates in the US. If the geopolitical storm settles, there should be a lot more deals,” said Vivek Soni, of EY India. Also, high company valuations partly driven by the IPO boom are hitting deal advancements. However, given the high investment appetite for India, there shouldn’t be a huge decline in deal value this year, Soni said. In all, PEVC investments (which includes VC funding in startups) slipped below $50 billion during Jan-Nov 2025 and is estimated to have closed the year flat without any major uptick y-o-y. Over the past three years, PE-VC deals averaged in the range of $52-$55 billion, analysts said.Global PE investors including Temasek, L Catterton, KKR and General Atlantic have been lining up India investments. A booming IPO market has made the exit process for PEs simpler, liquid and transparent, nudging them to bet on the country, said Ajay Tyagi of UTI AMC.Temasek and L Catterton rushed to take a bite of Haldiram’s last year while KKR made fresh round of investments in Lighthouse Learning to name a few deals. Consumer, healthcare, pharma and financial services—sectors that are reflective of India’s consumption growth have been driving investor interest. The deal pipeline for pharma looks quite hot for the year, said analysts, although healthcare may see consolidation with not very large deals in sight as of now. “Indian companies with strong domestic foundations are increasingly seeking global investments, as private equity can play a constructive role by bringing long-term capital, sector expertise, and global networks to help accelerate the next phase of growth,” said Devarajan Nambakam, co-head of India investment banking at Goldman Sachs. L Catterton has a “robust” pipeline of potential deals for the year comprising a mix of minority investments and buyouts, said India partner Vikram Kumaraswamy. Growing consumer preference for branded products and services coupled with an increasing organisation of consumption channels powered by tech are catalysing investment opportunities in India, said Kumaraswamy.